|

|

|

|

|

|

|

|

|

|||

|

|

|

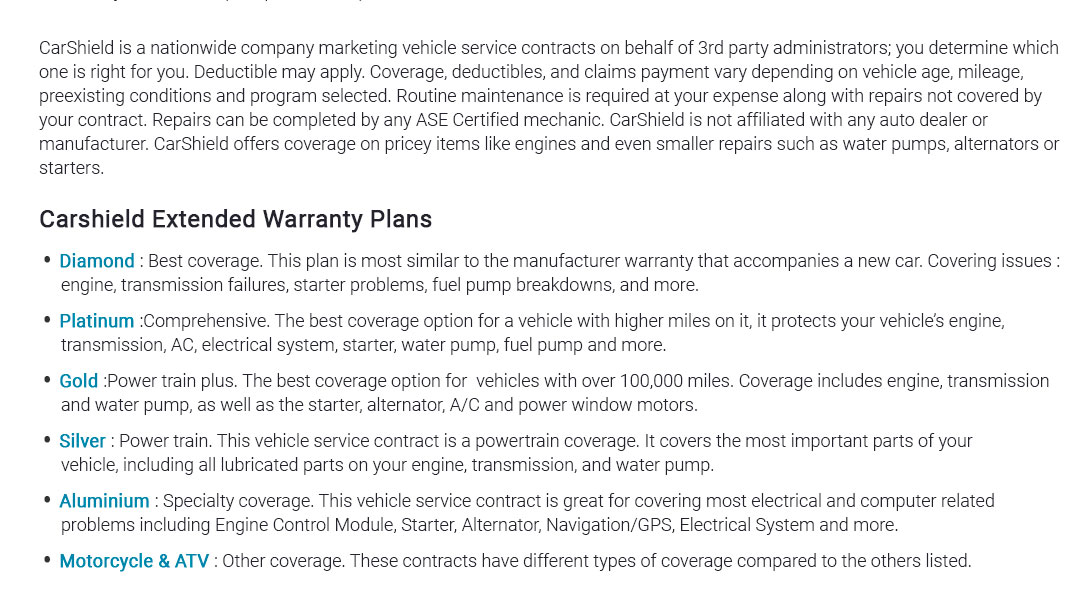

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

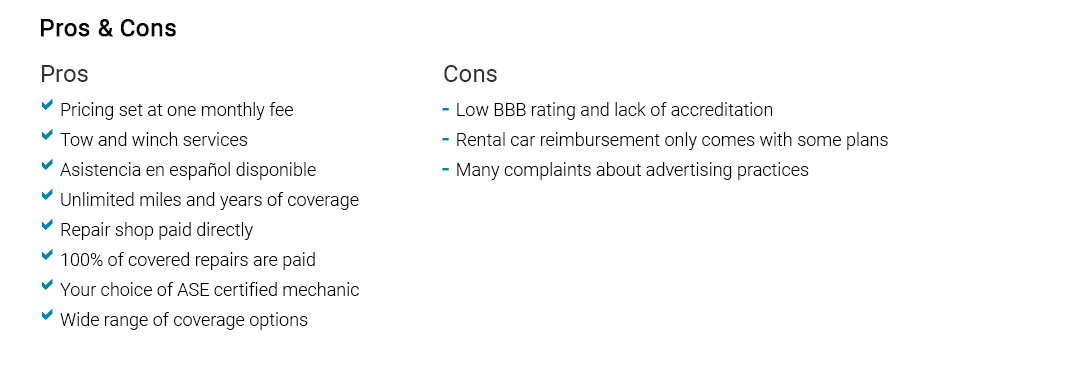

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

car repair insurance that puts you in control of costsWhy drivers consider itYou want fewer financial surprises and a smoother path to keeping your car on the road. Control and savings show up when big repair bills get capped by a policy instead of your wallet. It won't fit every driver, but it often turns chaos into a known monthly number.

How it worksYou pay a premium. A covered breakdown happens. You file a claim. You pay the deductible; the plan pays the rest up to limits.

A quiet Tuesday, a real-world momentThe check-engine light clicks on during a rainy commute. The car stumbles. You call the claims line, get a tow to a partner shop, and an hour later the diagnosis lands: alternator and tensioner. The estimate is $1,140. Your deductible is $100. You nod, authorize, and get back to your day - slightly inconvenienced, not financially derailed. What it usually covers - and what it doesn't

Insurance vs. warranties (quick take)Manufacturer warranties protect new cars for a set time; extended warranties mimic that but vary widely. Car repair insurance acts more like a policy with defined coverage tiers, deductibles, and claim rules, often usable on older vehicles. Overlap exists, but the claim mechanics and flexibility differ.

Decide like a finalizer

It isn't magic, but it can turn a volatile expense into a manageable plan with fewer interruptions. Savings math, simplifiedAdd last year's repairs or the model's typical failures. If the three-year expected cost is around $2,400 and a policy totals $1,500 over the same window with a $100 deductible, you're ahead - and you keep liquidity. Not every year wins, admittedly, but the ceiling on losses matters when budgets are tight. Control checklist before you buy

If you value predictable costs, smoother approvals, and protection from the one bill that ruins the month, car repair insurance earns the nod; if your savings easily absorb spikes, you may skip it and self-insure. Either path is valid - choose once, own the outcome, drive with confidence. https://www.businessinsider.com/personal-finance/auto-insurance/auto-repair-insurance

Auto repair insurance helps you cover the cost of major repairs and parts replacement. However, it won't cover fixes related to normal wear and tear, lack of ... https://www.cars.com/car-warranty/money/car-repair-insurance/

If your vehicle is older and out of warranty, a car repair insurance plan might save you money on unexpected repair costs. However, if you drive ... https://www.lemonade.com/car/explained/car-repair-insurance/

A type of insurance that covers the cost of repairing your car if it experiences mechanical failures not caused by an accident or wear and tear.

|